International Board Group

Get in Touch With Us

Office Address

Bank of the West Tower - 500 Capitol Mall, Sacramento, CA 95814

Email Address

Telephone

(650) 250 - 5845

The global semiconductor market, including AI-driven GPUs, is projected to reach $1.4 trillion by 2029, showcasing the growing demand for advanced computing solutions.

A Record-Breaking Valuation Milestone

Nvidia, a leader in AI-driven computing, is on the cusp of achieving a $3 trillion market valuation, highlighting its dominance in the tech sector. Following significant share sales by CEO Jensen Huang, worth over $700 million, Nvidia’s stock surged, closing 4% higher at $121 per share. The company’s valuation now stands at an impressive $2.97 trillion, underscoring its pivotal role in shaping the AI and chip design markets.

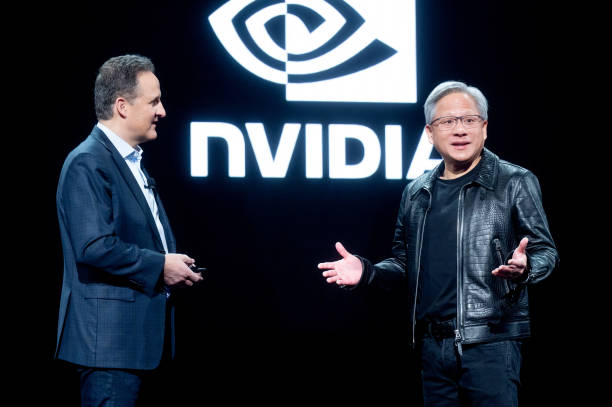

Strategic Leadership by Jensen Huang

Co-founder and CEO Jensen Huang has been instrumental in Nvidia’s meteoric rise. Since 1993, Huang has guided the company through revolutionary advancements in AI and GPU technology. In June, Nvidia briefly claimed the title of the world’s most valuable company, surpassing a $3.33 trillion valuation and outpacing tech giants like Apple and Microsoft. This growth reflects Nvidia’s strategic focus on AI, which has positioned it as a cornerstone of modern enterprise innovation.

Details of Huang’s Share Sales

Recent filings reveal that Huang sold 6 million Nvidia shares between June and September 2023, totaling approximately $713 million. Despite these transactions, he retains a significant stake, holding 75.4 million shares directly and controlling an additional 786 million shares through trusts. As Nvidia’s largest shareholder, Huang’s 3.8% stake signals his continued confidence in the company’s future, even as he diversifies his holdings.

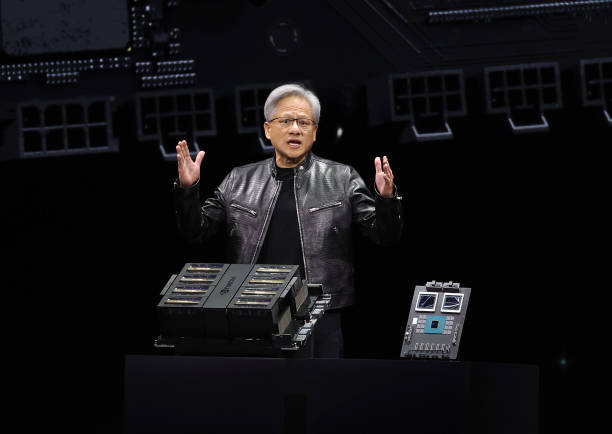

Nvidia’s Growth Driven by AI

Nvidia’s resurgence can be attributed to its pioneering role in AI hardware and computing. Its GPUs have become the gold standard for AI applications, powering data centers, autonomous vehicles, and advanced analytics. The global shift toward AI-driven solutions has placed Nvidia at the forefront of technological innovation, ensuring strong investor confidence despite periodic market volatility.

Challenges and Opportunities in Market Dynamics

While Nvidia remains a leader, it hasn’t been immune to fluctuations. Earlier this month, a tech sector selloff caused its stock to drop by 8%, erasing $280 billion in market value. However, a subsequent Federal Reserve interest rate cut fueled a recovery, emphasizing Nvidia’s resilience and long-term growth potential. Huang’s strategic share sales align with these dynamics, reflecting both market realities and his personal confidence in the company’s trajectory.

Positioning for the Future of AI

With its GPUs playing a central role in the AI revolution, Nvidia is poised for continued growth as businesses and governments invest heavily in AI infrastructure. The company’s focus on innovation ensures its technologies remain indispensable to a world increasingly reliant on machine learning and AI. Nvidia’s ability to adapt to evolving market needs will be critical in sustaining its leadership in this competitive space.

Leadership Insights for Boards and Executives

Jensen Huang’s strategic decisions and Nvidia’s performance offer key lessons for leaders. Effective governance during rapid growth requires a balance of innovation, market awareness, and strategic financial management. For executives and board members, Nvidia’s success highlights the importance of aligning leadership decisions with long-term value creation and adaptability in a volatile market.

“The computer industry is going through the most exciting time ever. AI will revolutionize every industry and amplify human ingenuity.”

Jensen Huang, CEO of Nvidia

More insights into the boardroom

Get In Touch

- [email protected]

- (650) 250 - 5845

Corporate Office

500 Capitol Mall, Sacramento, CA 95814