International Board Group

Get in Touch With Us

Office Address

Bank of the West Tower - 500 Capitol Mall, Sacramento, CA 95814

Email Address

Telephone

(650) 250 - 5845

As of 2023, there are over 20,000 strategic advisors and investors in north america alone, specializing in guiding high-growth businesses across sectors like technology, healthcare, and finance.

The Strategic Role of Advisors and Investors

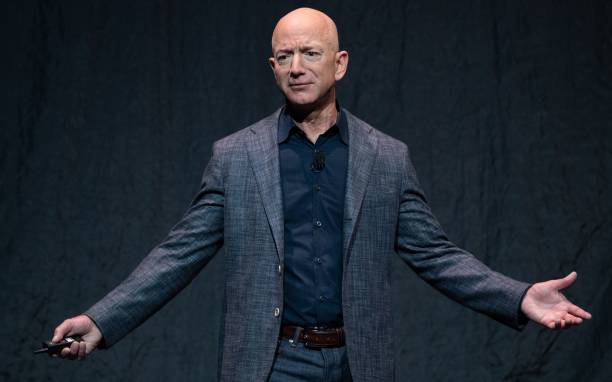

In an ever-changing business landscape, leveraging the insights of experienced advisors and investors can be a critical differentiator for organizational success. Figures like Jeff Bezos, founder of Amazon, and investors such as SoftBank bring not only financial backing but also the strategic foresight, industry connections, and innovative thinking needed to navigate complex markets. For boards and C-suite executives, these partnerships can unlock opportunities for growth, drive innovation, and solidify long-term competitiveness.

The Transformative Power of Advisors

Strategic advisors play a pivotal role in shaping a company’s direction. Jeff Bezos, renowned for his visionary leadership at Amazon, exemplifies how customer obsession and long-term thinking can drive business transformation. For board members and executive teams, emulating Bezos’s approach to scalability, resilience, and innovation offers a roadmap for navigating today’s challenges. Advisors who bring such expertise to the table can inspire leadership teams to align on strategic priorities and improve decision-making.

Strategic Investors as Partners in Growth

Investors like SoftBank go beyond providing capital—they offer strategic alignment and deep market insights. For boards, partnering with investors who understand industry trends can help drive informed decision-making and ensure alignment with the company’s long-term vision. Strategic investors also bring financial stability and credibility, opening doors to additional partnerships and positioning the company for global expansion.

How Advisors and Investors Enhance Governance

For boards of directors, the right advisors and investors provide not just expertise but a fresh perspective on governance. Advisors like Bezos bring a deep understanding of customer-centricity, while strategic investors like SoftBank offer insights into scaling businesses across regions. Together, they help boards anticipate market shifts, align with stakeholder interests, and foster resilient, forward-thinking organizations.

Best Practices for Building Strategic Relationships

C-suite executives and boards must be deliberate when selecting advisors and investors. Choosing individuals and firms aligned with the company’s values and goals ensures a productive relationship. Establishing clear expectations, fostering open communication, and leveraging their expertise are key to maximizing the value of these partnerships. For example, regular engagement with advisors on customer trends or market disruptions can guide boards in setting priorities and adapting governance practices.

The Board’s Role in Leveraging Expertise

Boards must actively integrate insights from advisors and investors into their strategic oversight. This requires an openness to adapting governance frameworks and embracing innovative ideas. For instance, applying Bezos’s focus on long-term growth over short-term wins can guide boards in approving investments that align with sustainable success. Similarly, using market insights from strategic investors can shape decisions on expansion, partnerships, and risk mitigation.

Driving Success Through Leadership and Strategy

The collective power of advisors, investors, and engaged leadership teams creates a robust foundation for long-term success. By tapping into the expertise of figures like Bezos and visionary investors, organizations can drive innovation, align their strategic goals with market opportunities, and foster sustainable growth. Boards and executive teams that prioritize these relationships position their companies to not only adapt but thrive in today’s dynamic markets.

“If you’re competitor-focused, you have to wait until there is a competitor doing something. Being customer-focused allows you to be more pioneering.”

Jeff Bezos, CEO of Amazon

More insights into the boardroom

Get In Touch

- [email protected]

- (650) 250 - 5845

Corporate Office

500 Capitol Mall, Sacramento, CA 95814